MRC Vegas 2024: A Recap

We came back from a long but eventful week at Merchant Risk Council's annual conference in Las Vegas. This year, it ran from March 25 until March 28 and was jam-packed with sessions, workshops, and great conversation all about fraud and payments.

Basis Theory also exhibited and had opportunities to hear the wins and challenges many merchants face with payments today.

Here are some of our takeaways.

A Nod to Network Tokens & Tokenization

It is no surprise that network tokens came up quite frequently in conversations this year. Google Trends continues to see a rise in searches for network tokens, and dozens of articles are published each day covering their use.

What was once more of a conceptual unknown is catching hold in 2024. Issuer support is growing, and fees like the Secure Credential Framework Integrity Fee that Visa rolled out in late 2023 give merchants more incentive than ever to adopt network tokens.

Interestingly, when payments professionals bring up "tokens", network tokens is often the intended meaning. However, payment tokenization is so much broader than that.

A network token is distributed by the card networks (Visa, Mastercard, American Express, and Discover) and can only be used through the card networks themselves or their partner merchants. Whereas, universal (or agnostic) tokens are tokens that can be used in place of the plaintext payment data for transactions across various different channels, payment networks, and processors without exposing the underlying data.

Each token type has its benefits and drawbacks but we're certainly partial to the flexibility of agnostic payment tokens. We love talking about tokenization, so feel free to reach out to our team and we'd love to have a chat about token types.

Combatting Fraud is a BIG Challenge

According to the 2024 Global eCommerce Payments & Fraud Report, merchants are facing more fraud attacks than ever with the types of fraudulent activity they experienced increasing from 3 to 4, on average. According to this report, 94% of MRC members had experienced first-party misuse fraud in the last 12 months.

When walking around the exhibit hall, we couldn't help but notice just how many solution providers are working toward solving this problem. As fraudsters become more sophisticated - for instance, by leveraging AI to attack at scale - the solutions will also continue to evolve in this space.

We are interested to see the ways Fraud Management will continue to evolve in the coming years.

Payment Partners Keep the World Spinning

Many merchants explained how their selection of payment partners has a huge impact on payments success. That given the ability to build their ideal payments stack on their terms, these merchants can innovate faster and grow revenue.

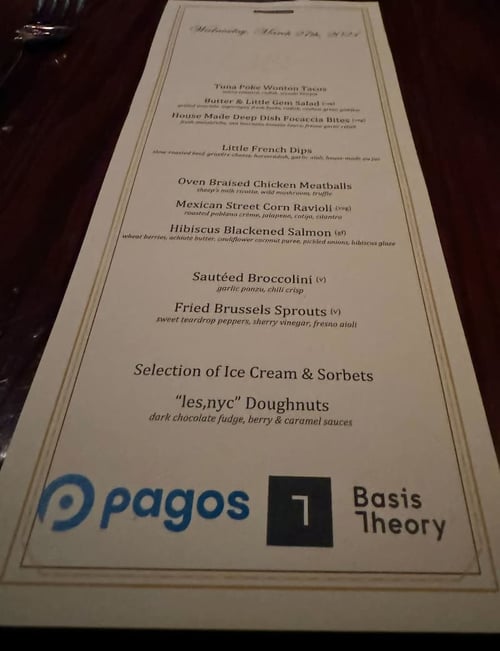

We agree, and we appreciate the strong relationships we have with many amazing partners. We co-hosted a dinner on Wednesday, March 27 at Beauty & Essex with our partner, Pagos. It was an evening of great food and even better conversation as we heard stories from many innovative merchants making smart payments moves.

Main Takeaway: We Can't Wait Until Next Year

We had a blast at MRC Vegas 2024, and we know many of you did, too. We look forward to next year's event and hope to see you there.

.png?width=365&height=122&name=BTLogo%20(1).png)